Apply for PM Kamyab Jawan Loan 2025

If you want to start your own business in Pakistan but lack financial resources, the PM Kamyab Jawan Loan 2025 program is your golden opportunity. This scheme allows youth, students, women, and entrepreneurs to access loans on easy and affordable terms to launch or expand their businesses.

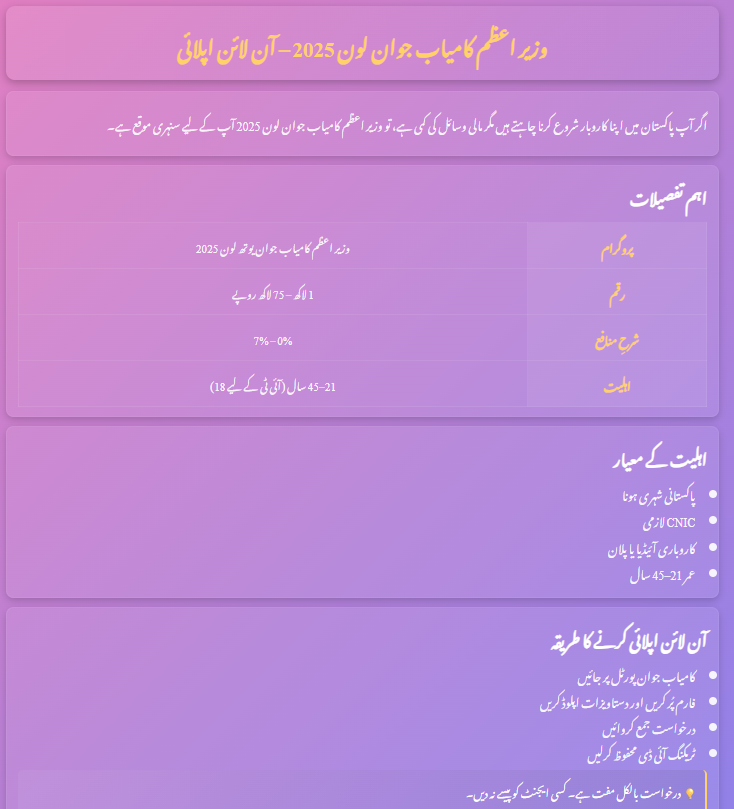

Quick Overview – PM Kamyab Jawan Loan 2025

| Feature | Details |

|---|---|

| Program Name | PM Kamyab Jawan Youth Loan 2025 |

| Start Date | January 2025 |

| Application Deadline | December 2025 (Applications open all year) |

| Loan Amount | Rs. 100,000 – Rs. 7.5 Million |

| Interest Rate | 0% – 7% (Depends on loan tier) |

| Eligible Age | 21–45 years (18 years for IT/E-commerce) |

| Target Group | Students, unemployed youth, women, entrepreneurs |

| Supervised By | State Bank of Pakistan with partner banks |

Latest Updates (October 2025)

- Tier-1 loan limit increased to Rs. 1.5 million (previously Rs. 1 million).

- Online tracking system launched – applicants can now check their loan status using CNIC.

- 5% additional quota for women applicants announced.

- Fast-track approvals for IT startups to encourage innovation.

Why This Loan Scheme Matters

- 🎯 Financial independence – Start your own business instead of waiting for a job.

- 👩💼 Women empowerment – Dedicated quota and special support.

- 💻 Boost for innovation – IT, agriculture, and e-commerce businesses prioritized.

- 📈 Economic growth – More businesses mean more jobs in Pakistan.

Loan Categories (Tiers)

| Tier | Loan Range | Interest Rate | Repayment Time |

|---|---|---|---|

| Tier 1 | Rs. 100,000 – Rs. 1.5 Million | 0% | Up to 8 years |

| Tier 2 | Rs. 1.5 Million – Rs. 5 Million | 5% | Up to 8 years |

| Tier 3 | Rs. 5 Million – Rs. 7.5 Million | 7% | Up to 8 years |

Eligibility Criteria

- Must be a Pakistani citizen with a valid CNIC.

- Age limit: 21–45 years (minimum 18 years for IT/E-commerce startups).

- Must have a business idea or plan.

- Students, unemployed youth, and women are encouraged to apply.

- Both new startups and existing businesses are eligible.

Required Documents

- Copy of CNIC

- Passport-size photograph

- Bank account details

- Educational certificates (if available)

- Business plan (mandatory)

- Experience/skill certificates (optional but recommended)

Step-by-Step Online Application

- Visit the official Kamyab Jawan Loan portal.

- Open the application form for 2025.

- Enter personal, educational, and contact details.

- Select the loan tier (Tier 1, 2, or 3).

- Upload the required scanned documents.

- Submit the form and save your tracking ID.

- Wait for bank verification and approval.

💡 Note: Application is completely free of cost. Do not pay agents or middlemen.

Common Problems & Pro Tips

- Website may be slow due to heavy traffic.

- Applications without a clear business plan are often rejected.

- Incorrect or incomplete documents lead to rejection.

- Bank verification sometimes takes longer than expected.

👉 Pro Advice: Prepare your business plan, CNIC, and bank details in advance to avoid delays.

Key Features & Benefits

- Interest-free loan under Tier 1.

- Repayment period up to 8 years.

- Loans backed by State Bank of Pakistan.

- Special quota for women and youth.

Tips to Increase Approval Chances

- Write a simple 1-page business plan (idea, target market, expected profit).

- Ensure scanned documents are clear and readable.

- Double-check CNIC and bank details.

- Apply early, especially for IT, agriculture, or e-commerce businesses.

- Keep your tracking ID safe for follow-ups.

Final Words

The PM Kamyab Jawan Loan 2025 is a golden opportunity for Pakistan’s youth to turn their ideas into reality. With interest-free loans, easy installments, and government-backed support, this program empowers students, women, and entrepreneurs to create jobs and contribute to Pakistan’s economy.

👉 Don’t wait – apply today through the official portal and take your first step toward becoming your own boss.

FAQs – PM Kamyab Jawan Loan

Q1: Can women apply for this loan?

Yes, women are strongly encouraged and a special quota has been reserved.

Q2: What is the minimum loan amount?

The minimum loan is Rs. 100,000 under Tier 1.

Q3: Is a business plan mandatory?

Yes, even a simple business plan is required.

Q4: How long does approval take?

Approval usually takes a few weeks, depending on the bank.

Q5: Can existing businesses apply?

Yes, both new startups and existing businesses are eligible.